Unlocking Trading Potential and Funding Opportunities

The journey to becoming a successful trader can be both exciting and challenging. One platform that has garnered attention in the trading community is Topstep. It offers a unique opportunity for traders to prove their skills and access funded trading accounts. In this comprehensive review, we’ll dive deep into what Topstep offers, how it works, its pros and cons, and whether it’s a valuable stepping stone for aspiring traders.

The Topstep Experience:

Topstep operates on a straightforward premise: traders are evaluated based on their ability to generate consistent profits and manage risk. Here’s how it works:

1. Trading Evaluation:

The journey begins with a Trading Evaluation. Traders select a challenge that aligns with their trading goals, whether in forex or futures markets. Each challenge comes with specific rules and profit targets. Traders are provided with a simulated trading account and are tasked with meeting daily and overall profit goals.

2. Proving Skills:

Throughout the evaluation, traders must adhere to strict risk management rules. This phase tests not only trading acumen but also discipline and risk management skills. Meeting the objectives successfully qualifies traders for the next stage.

3. Funded Account:

Upon passing the evaluation, traders move on to the Funded Account stage. Here, they gain access to real trading capital provided by Topstep’s funding partners. The size of the funded account depends on the challenge completed.

4. Profit Sharing:

While trading the funded account, traders share a portion of their profits with Topstep. The profit-sharing arrangement varies, but it provides an opportunity to trade with real money without personal risk.

The Pros of Topstep:

- Risk Management Emphasis: Topstep instills sound risk management practices, a vital skill for any trader.

- Education and Community: Topstep offers educational resources and access to a trading community, fostering learning and idea exchange.

- Path to Funding: Successful traders can access real trading capital, potentially accelerating their trading careers.

The Cons of Topstep:

- Challenging Evaluation: Passing the Trading Evaluation is not easy, and many traders may not succeed on their first attempt.

- Costs: Participation involves fees for the evaluation, and traders must also cover market data fees.

- Profit Sharing: Traders are required to share profits with Topstep, impacting their overall earnings.

Trading Evaluation:

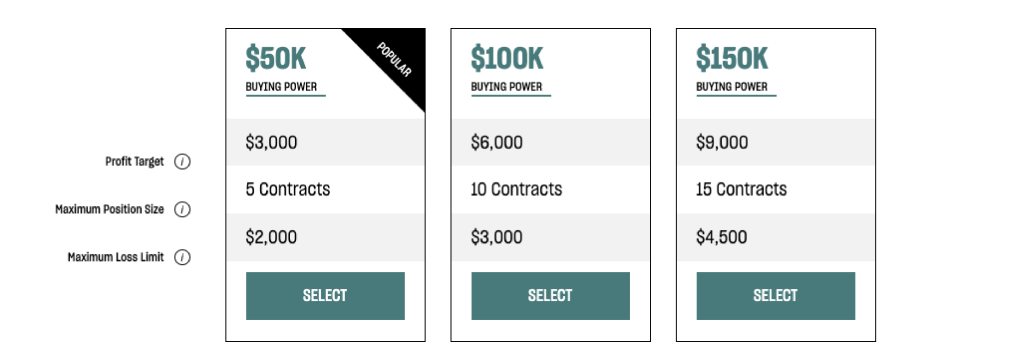

Step 1 – Choose a Challenge: Traders began by selecting a challenge based on the market they wanted to trade (e.g., forex, futures) and the level of funding they desired. Each challenge had specific rules and objectives.

Step 2 – Simulated Account: Once enrolled in a challenge, traders received access to a simulated trading account with virtual capital. The account replicated real-market conditions, including market data and pricing.

Step 3 – Trading Objectives: Traders were given specific daily and overall profit targets to achieve within a defined trading period, typically a few weeks. The objectives aimed to evaluate traders’ ability to manage risk and generate consistent profits.

Step 4 – Risk Management: Traders were required to adhere to strict risk management rules, including maximum daily loss limits. Failure to follow these rules could result in disqualification from the evaluation.

Evaluation Process:

- Trading Platform: Traders used a trading platform provided by Topstep, which was compatible with the market they were trading.

- Real-Time Metrics: Traders could monitor their progress in real-time, including their profit and loss, equity curve, and other performance metrics.

- Performance Analysis: Topstep evaluated traders’ performance based on their ability to meet the predefined profit targets while adhering to risk management rules. Traders who met these criteria moved on to the next stage.

Funded Account:

- Scaling Process: Once a trader passed the evaluation, they progressed to the Funded Account stage. In this stage, traders were given access to real money, which was provided by Topstep’s funding partners.

- Profit Sharing: Traders who received funding had to share a portion of their profits with Topstep, typically in the range of 20% to 50%. The profit-sharing arrangement varied depending on the chosen challenge and funding level.

- Account Size: The size of the funded account depended on the specific challenge completed successfully. Traders could choose to increase their funding targets by opting for more challenging evaluation programs.

- Risk Management Continues: Even in the funded stage, traders were required to follow strict risk management rules and meet profit targets. Failure to do so could result in the termination of the funded account.

Additional Features:

- Education and Resources: Topstep provided educational materials, webinars, and access to a trading community to help traders improve their skills.

- Support: Traders had access to customer support for assistance with technical issues and questions related to the program.

- Trading Community: Topstep fostered a community of traders where participants could share insights, strategies, and experiences.

Costs:

- Program Fees: Traders were required to pay a fee to participate in the evaluation program. The fee varied based on the challenge and funding level chosen.

- Data Fees: Traders were responsible for any market data fees associated with the platform.

Cancellation and Changes:

- Terms and Conditions: Topstep’s terms and conditions, including profit-sharing arrangements and program rules, could change over time. Traders needed to stay informed about any updates.

Conclusion:

Topstep provides a distinctive opportunity for traders to gain experience, prove their skills, and access funded trading accounts. While it presents challenges and costs, it can serve as a valuable stepping stone for aspiring traders looking to break into the world of professional trading.

Before embarking on the Topstep journey, it’s crucial to thoroughly understand the program’s rules, risk management principles, and associated costs. Conducting diligent research and considering recent reviews and experiences of other traders will provide valuable insights into whether Topstep aligns with your trading goals and aspirations.

Remember that success in trading involves continuous learning, discipline, and a deep understanding of the markets. Topstep may offer the platform to kickstart your trading career, but it’s your commitment and skill that will ultimately determine your success.